BLIP

Basic Life Insurance Plan (BLIP) is provided to all KCoop members and staff members of KCoop, KDCI, and KMBA. Moreover, client-beneficiaries of KMBA partner microfinance institutions, members of cooperatives, informal workers, development workers, and other organized basic sectors may avail themselves of KMBA associate membership.

BLIP

Basic Life Insurance Plan (BLIP) is provided to all client-beneficiaries and staff members of Kasagana-Ka Synergizing Organizations (KSO) as well as to client-beneficiaries of KMBA partner microfinance institutions and other organized community or basic sector groups

Amount of Weekly ContributionPHP20 =

- PHP15 for insurance premium and

- PHP5 for the retirement savings fund

Membership Benefits

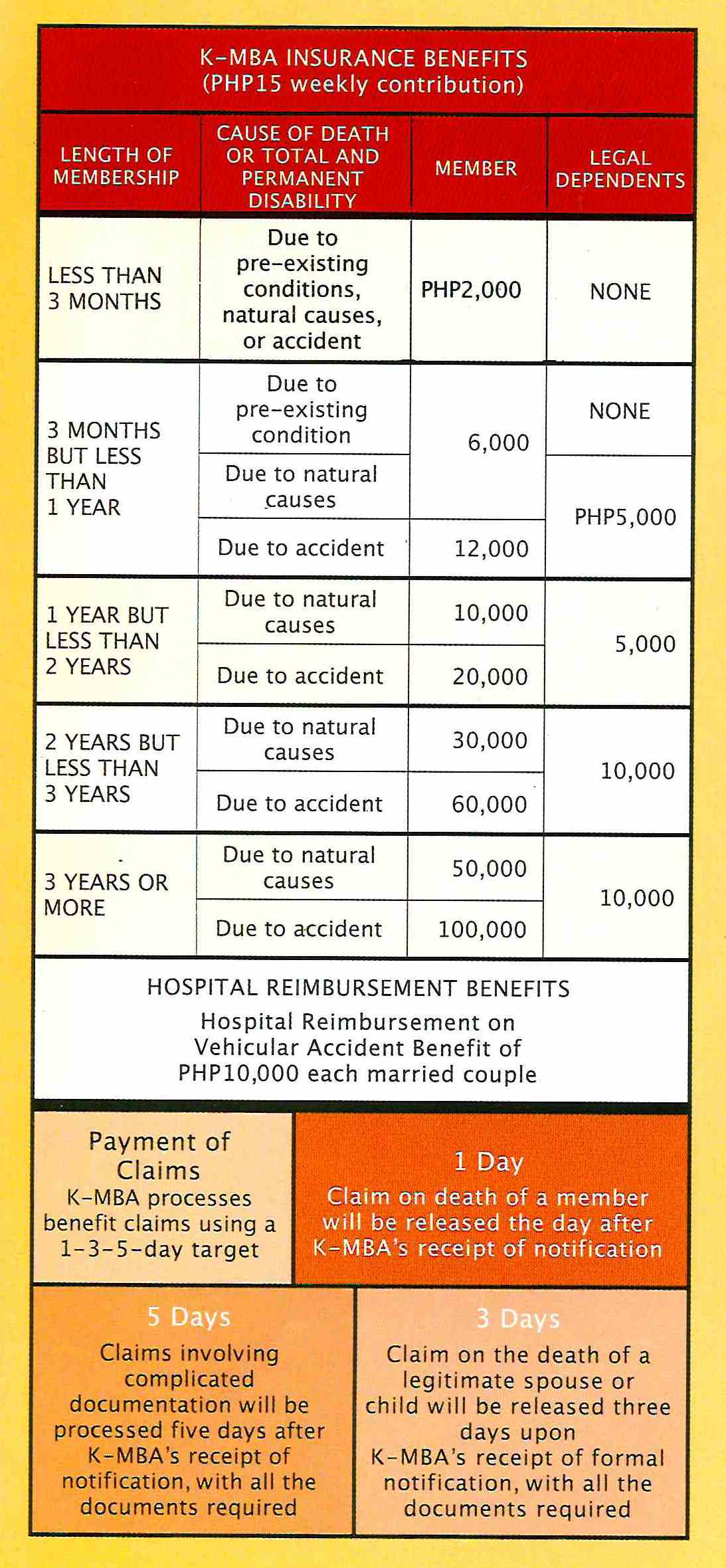

- Life insurance with total and permanent disability. This benefit is given upon the death (other than suicide) or permanent disability of a member or the legitimate spouse or children below 21 years old

- Motor vehicle accident and hospitalization benefit. This is given for at least 12-hour hospital confinement due to vehicular accident of a member or the legitimate spouse. Total claims during the entire insurance coverage should not exceed PHP10,000 for both the member and the spouse every year.

- Retirement savings fund. The weekly PHP5 contribution, which earns 2 percent annual interest, will be refunded upon termination of membership.

- Refund of insurance premium. A member is entitled to at least 50 percent of the equity value of the total contribution upon resignation, death or retirement at the age of 65.

KMBA's insurance coverage is terminated upon a member's

- Resignation

- Disqualification

- Retirement (65 years old)

- Death

- Permanent disability

- Failure to remit contribution after the 45-day grace period

Contestability Period

- On the first year of membership, KMBA will not pay claims on the death or permanent disability of a legitimate spouse or dependent children, if the cause is due to a pre-existing condition.